Understanding the intricacies of financial audits is crucial for businesses of all sizes, from small startups navigating their first financial year to multinational corporations managing billions. Financial audits aren’t simply about complying with regulations; they’re a vital tool for assessing financial health, identifying areas for improvement, and ultimately, driving long-term success. This exploration delves into the diverse world of financial audits, clarifying the distinctions between various types and their respective purposes.

This guide will navigate you through the landscape of internal and external audits, examining the unique roles of financial statement audits, compliance audits, and operational audits. We will explore the processes involved, the key players, and the overall impact these audits have on an organization’s financial stability and operational efficiency. By the end, you’ll have a clear understanding of how to choose the right type of audit for your specific needs and leverage the insights gained to make informed business decisions.

Types of Financial Audits

Financial audits are crucial for ensuring the accuracy and reliability of financial information. They provide an independent assessment of an organization’s financial health and compliance with relevant regulations. Different types of audits exist, each serving a specific purpose and employing distinct methodologies.

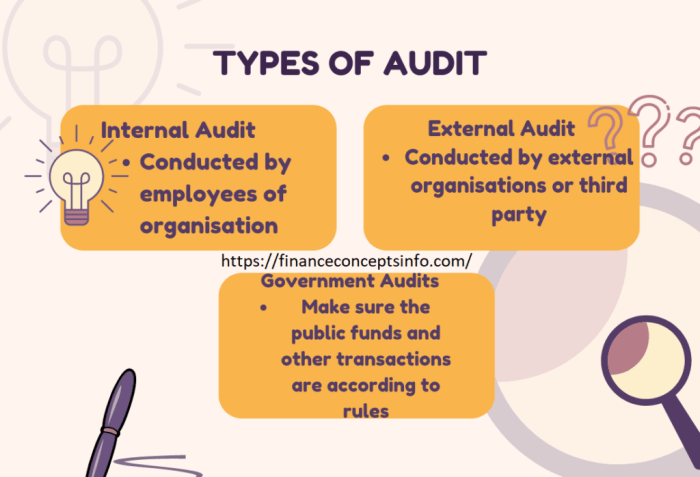

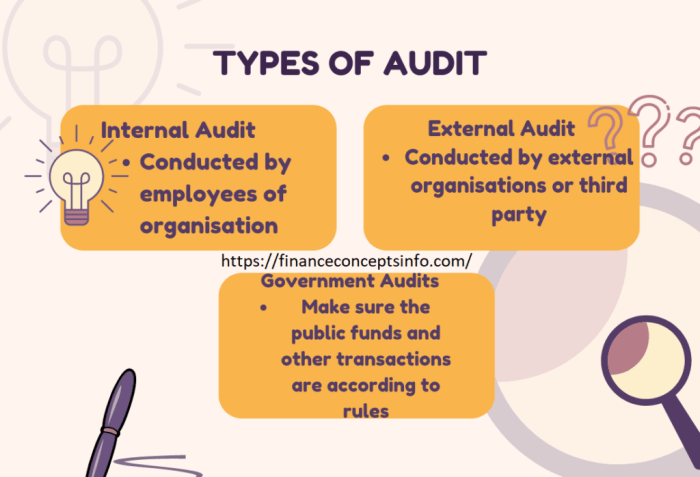

Internal vs. External Audits

Internal and external audits, while both aimed at evaluating financial information, differ significantly in their scope, objectives, and the nature of their reporting. Internal audits are conducted by employees of the organization itself, whereas external audits are performed by independent, external auditors.Internal audits focus on assessing the effectiveness and efficiency of the organization’s internal controls, processes, and risk management frameworks.

The objective is to identify areas for improvement within the organization, enhance operational efficiency, and mitigate potential risks. Internal audit reports are typically confidential and used internally for management decision-making.External audits, on the other hand, provide an independent verification of the organization’s financial statements. The primary objective is to express an opinion on whether the financial statements are presented fairly, in all material respects, in accordance with applicable accounting standards.

These reports are publicly available and are used by investors, creditors, and other stakeholders to assess the organization’s financial position.

Comparison of Audit Types

The following table summarizes the key characteristics of various types of financial audits:

| Type | Purpose | Scope | Key Differences |

|---|---|---|---|

| Financial Statement Audit | To express an opinion on the fairness of financial statements. | Entire financial statements, including balance sheet, income statement, and cash flow statement. | Independent external auditors; follows generally accepted auditing standards (GAAS); results in an audit report expressing an opinion. |

| Compliance Audit | To determine whether the organization is complying with relevant laws, regulations, and internal policies. | Specific areas of the organization’s operations related to compliance requirements. | Focuses on adherence to rules and regulations; may be conducted internally or externally; often involves reviewing documentation and procedures. |

| Operational Audit | To evaluate the effectiveness and efficiency of the organization’s operations and internal controls. | Specific processes, functions, or departments within the organization. | Focuses on improving operational efficiency and effectiveness; often conducted internally; may involve reviewing processes, procedures, and performance indicators. |

| Internal Audit | To assess the effectiveness of internal controls, identify risks, and recommend improvements. | Varies depending on the organization’s needs and risks; can cover financial, operational, and compliance aspects. | Conducted by internal audit staff; reports to management; focuses on continuous improvement and risk mitigation. |

Financial Statement Audit

A financial statement audit is a systematic and independent examination of a company’s financial records and statements to determine whether they present a fair and accurate picture of the company’s financial position and performance. This process provides assurance to stakeholders, including investors, creditors, and regulators, that the financial information is reliable and can be used for informed decision-making. The audit is conducted by independent external auditors who are qualified and experienced in accounting and auditing principles.

The Financial Statement Audit Process

The financial statement audit process is a structured approach involving several key phases, from initial planning to the final issuance of the audit report. Each phase requires meticulous attention to detail and adherence to established auditing standards. A thorough understanding of the client’s business, industry, and internal controls is crucial for effective audit planning and execution. The process involves a significant amount of professional judgment and critical thinking.

Key Steps in Planning and Executing a Financial Statement Audit

Planning is the cornerstone of a successful audit. This phase involves understanding the client’s business, assessing risks, developing an audit strategy, and determining the scope and timing of the audit procedures. Execution involves gathering and evaluating audit evidence, testing internal controls, and performing substantive procedures on various financial statement accounts. This requires a well-defined methodology and close collaboration between the audit team and the client’s management.

The Role of Generally Accepted Auditing Standards (GAAS)

Generally Accepted Auditing Standards (GAAS) are the fundamental principles that govern the conduct of financial statement audits. These standards are established by the Auditing Standards Board (ASB) of the AICPA (American Institute of Certified Public Accountants) in the United States and are designed to ensure the quality, consistency, and reliability of audit work. Compliance with GAAS is essential for maintaining the credibility and integrity of the audit process and the resulting audit report.

GAAS covers areas such as auditor independence, professional skepticism, due professional care, and the gathering and evaluation of sufficient appropriate audit evidence.

Common Audit Procedures Used in a Financial Statement Audit

The following audit procedures are commonly used to gather evidence and assess the fairness of financial statements:

- Inspection of records and documents: Examining supporting documentation for transactions and balances, such as invoices, receipts, and contracts.

- Observation: Watching the client’s personnel perform certain accounting procedures to assess the effectiveness of internal controls.

- Inquiry: Asking questions of management, employees, and other relevant parties to gather information and understand the client’s business and accounting practices.

- Confirmation: Obtaining direct written evidence from third parties, such as banks and customers, to verify account balances and transactions.

- Recalculation: Independently checking the accuracy of mathematical computations performed by the client.

- Reperformance: Independently performing accounting procedures performed by the client to verify their accuracy and completeness.

- Analytical procedures: Analyzing financial data to identify unusual trends or patterns that may indicate potential misstatements.

- Substantive testing: Performing detailed tests of transactions and balances to verify their accuracy and completeness.

Compliance Audit

A compliance audit is an independent examination of an organization’s adherence to applicable laws, regulations, and internal policies. Its primary objective is to assess the effectiveness of the organization’s internal controls in ensuring compliance and to identify any areas of non-compliance. This process helps organizations mitigate risks, avoid penalties, and maintain a strong reputation.Compliance audits differ significantly from financial statement audits, focusing on the qualitative aspects of adherence to rules rather than the quantitative accuracy of financial reporting.

Regulations and Laws Addressed in Compliance Audits

Compliance audits cover a broad spectrum of regulations and laws, depending on the industry and the organization’s operations. The specific regulations examined will vary greatly. For example, a publicly traded company will face different compliance requirements than a small privately held business. Some common areas addressed include:

- Environmental regulations (e.g., Clean Air Act, Clean Water Act): These audits verify that a company is complying with environmental protection laws, such as emission standards and waste disposal procedures.

- Labor and employment laws (e.g., Fair Labor Standards Act, Occupational Safety and Health Act): These audits assess compliance with laws related to wages, working conditions, and employee safety.

- Financial regulations (e.g., Sarbanes-Oxley Act, Dodd-Frank Act): These audits are particularly relevant for publicly traded companies and financial institutions, focusing on areas such as internal controls, financial reporting, and corporate governance.

- Healthcare regulations (e.g., HIPAA, Affordable Care Act): Healthcare providers and organizations handling protected health information are subject to audits ensuring compliance with these regulations.

- Tax laws (e.g., Internal Revenue Code): These audits verify accurate tax reporting and compliance with relevant tax laws and regulations.

Comparison of Compliance and Financial Statement Audits

While both compliance and financial statement audits involve an independent examination, their scopes and objectives differ substantially. A financial statement audit focuses on the fairness and accuracy of an organization’s financial statements, ensuring they are presented in accordance with generally accepted accounting principles (GAAP). In contrast, a compliance audit focuses on the organization’s adherence to external laws and regulations and internal policies.

A financial statement audit is primarily quantitative, dealing with numbers and financial data, while a compliance audit is more qualitative, evaluating processes and procedures. Both, however, aim to identify weaknesses and areas for improvement within the organization.

Steps in a Typical Compliance Audit

A compliance audit typically follows a structured process. A well-defined plan is crucial to ensure the audit is comprehensive and efficient.

- Planning and scoping: This initial stage involves defining the scope of the audit, identifying relevant regulations and laws, and establishing audit objectives and timelines. This includes understanding the organization’s structure, operations, and risk profile.

- Risk assessment: This step involves identifying potential areas of non-compliance based on the organization’s operations and industry-specific risks. This helps prioritize areas for detailed examination.

- Testing and evidence gathering: Auditors collect evidence to determine whether the organization is complying with relevant regulations. This might involve reviewing documents, interviewing personnel, and performing on-site observations.

- Reporting and recommendations: The audit findings are documented in a formal report, which includes details on areas of compliance and non-compliance, along with recommendations for improvement. This report might also include a management letter with detailed suggestions for remediation.

- Follow-up and monitoring: After the report is issued, management takes steps to address the identified deficiencies. A follow-up review may be conducted to ensure the corrective actions are effective.

Operational Audit

Operational audits assess the efficiency and effectiveness of an organization’s operations. Unlike financial audits which focus on the accuracy of financial statements, operational audits examine how well an organization is achieving its objectives and utilizing its resources. They are designed to identify areas for improvement and help organizations optimize their processes.Operational audits delve into the day-to-day workings of an organization, examining everything from internal controls and resource allocation to the effectiveness of specific programs and processes.

The goal is to provide management with actionable insights to enhance performance and achieve better results.

Areas Subject to Operational Audit

Operational audits can cover a wide range of organizational functions. The specific areas selected for review depend on the organization’s goals and priorities, as well as any identified risk areas. Examples include:

- Production processes: An operational audit might assess the efficiency of a manufacturing plant’s production line, identifying bottlenecks and suggesting improvements to streamline operations and reduce waste.

- Supply chain management: Auditors might examine the effectiveness of the organization’s procurement processes, inventory management, and logistics to identify areas for cost reduction and improved efficiency.

- Customer service: An operational audit could evaluate the effectiveness of customer service strategies, including response times, resolution rates, and customer satisfaction levels.

- Information technology (IT): The audit might assess the efficiency and security of an organization’s IT infrastructure, including data management, cybersecurity protocols, and system performance.

- Human resources (HR): Operational audits can review HR processes, such as recruitment, training, performance management, and employee relations, to ensure effectiveness and compliance.

Improving Efficiency and Effectiveness Through Operational Audits

Operational audits provide a systematic approach to identifying inefficiencies and areas for improvement. By analyzing data and processes, auditors can pinpoint bottlenecks, redundancies, and areas where resources are being wasted. This analysis then informs recommendations for process improvement, leading to increased efficiency and effectiveness. For example, an operational audit of a hospital’s emergency room might reveal long wait times due to inefficient triage processes.

The audit could then recommend changes to the triage system, leading to shorter wait times, improved patient satisfaction, and better resource utilization. Similarly, an operational audit of a sales department might identify that a particular sales technique is consistently underperforming, allowing for a shift in strategy and improved sales results.

Data Collection Methods in Operational Audits

Several methods are used to collect data during an operational audit. The specific techniques employed will depend on the scope of the audit and the specific areas under review. Common methods include:

- Interviews: Auditors conduct interviews with employees at all levels of the organization to gather information on processes, challenges, and best practices.

- Observations: Direct observation of processes and operations provides firsthand insights into how things actually work. This allows auditors to identify discrepancies between documented procedures and actual practice.

- Document review: Examining relevant documents such as policies, procedures, reports, and performance data provides valuable context and quantitative data for analysis.

- Data analysis: Statistical analysis of operational data, such as production output, customer satisfaction scores, and cost figures, helps to identify trends and patterns.

- Benchmarking: Comparing the organization’s performance against industry best practices or similar organizations can identify areas for improvement and highlight potential opportunities.

Internal Controls Audit

Internal controls are the backbone of reliable financial reporting. A robust system of internal controls helps ensure the accuracy, completeness, and reliability of financial statements, safeguarding assets, and promoting operational efficiency. An internal controls audit assesses the design and operating effectiveness of these controls, providing assurance to stakeholders about the integrity of the financial reporting process.

Types of Internal Controls

Internal controls are categorized into three main types based on their function: preventative, detective, and corrective. Preventative controls aim to stop errors or irregularities before they occur. Detective controls identify errors or irregularities after they have happened. Corrective controls remedy the effects of errors or irregularities that have been detected. A comprehensive system of internal controls utilizes all three types to provide a layered approach to risk mitigation.

Internal Controls Audit Procedures

An internal controls audit involves a systematic examination of the design and operating effectiveness of an organization’s internal control system. This typically includes a review of policies and procedures, documentation review, observation of processes, and testing of controls through various procedures such as walkthroughs, inquiries of personnel, and re-performance of controls. Auditors use professional judgment and relevant frameworks, such as the COSO framework, to assess the effectiveness of the controls and identify any significant deficiencies or material weaknesses.

The results of the audit provide valuable insights for management to improve the internal control system and enhance the reliability of financial reporting.

Common Internal Control Weaknesses and Their Potential Impact

A well-designed internal controls audit should identify and assess the potential impact of common internal control weaknesses. Understanding these weaknesses is crucial for effective risk management.

- Lack of Segregation of Duties: A single individual having control over multiple aspects of a transaction (authorization, recording, and custody) increases the risk of fraud or error. This could lead to misappropriation of assets or inaccurate financial reporting.

- Inadequate Authorization Procedures: Insufficient or poorly defined authorization procedures can result in unauthorized transactions, potentially leading to financial losses or non-compliance with regulations.

- Poor Documentation and Record-Keeping: Incomplete or inaccurate documentation makes it difficult to track transactions and identify errors, hindering the ability to detect fraud and ensure accurate financial reporting. This can result in misstatements in financial statements and difficulty in audits.

- Insufficient Oversight and Monitoring: A lack of regular monitoring and review of internal controls allows weaknesses to persist and potentially escalate, leading to significant errors or fraud that may go undetected for extended periods.

- Weak Access Controls: Inadequate security over systems and data can allow unauthorized access, leading to data breaches, loss of sensitive information, and potential financial losses.

- Failure to Perform Regular Reconciliations: Reconciliations are crucial for detecting discrepancies between internal records and external statements. Failure to perform them regularly increases the risk of errors and fraud going unnoticed.

Financial Advice, Auditing, Planning, and Goals

Financial advice, auditing, planning, and goal setting are interconnected elements crucial for achieving long-term financial success. They form a cyclical process where each component informs and influences the others, creating a robust framework for managing personal or business finances. Understanding their interrelationship is key to making informed decisions and mitigating potential risks.Financial auditing provides a snapshot of a company’s or individual’s current financial health.

Financial planning uses this information to establish realistic goals and develop strategies to reach them. Financial advice guides the implementation of these plans, and the resulting outcomes inform future audits and adjustments to plans. This continuous feedback loop ensures that financial strategies remain relevant and effective over time.

The Interrelationship Between Financial Advice, Auditing, Planning, and Goals

Financial advice acts as a guide, providing expert insights into various financial instruments, investment strategies, and risk management techniques. This advice is tailored to an individual’s or organization’s specific financial situation, goals, and risk tolerance. Financial planning, informed by this advice, translates high-level goals into actionable steps, creating a detailed roadmap for achieving financial objectives. Financial audits then objectively assess the progress made against this plan, highlighting areas of strength and weakness.

The audit results are then fed back into the planning process, leading to adjustments and refinements. This iterative process ensures that the financial strategy remains aligned with the evolving circumstances and goals. For example, a business might set a goal of increasing profitability by 15% in the next fiscal year. Financial planning might involve strategies like cost-cutting measures and new product development.

A financial audit would then assess the actual profitability achieved, revealing whether the planning and implementation were successful or required adjustments.

Examples of How Financial Audits Inform Financial Planning and Goal Setting

A financial audit can reveal inconsistencies in revenue recognition, leading to a reassessment of sales projections in the financial plan. Similarly, an audit highlighting inefficient expense management might prompt a review of budgeting practices and the implementation of cost-saving measures. If an audit uncovers high levels of debt, the financial plan might be revised to prioritize debt reduction as a primary goal.

For instance, an audit revealing significant inventory write-downs could lead to a revised sales strategy focused on inventory turnover, influencing both the sales goals and the marketing plan. In another example, a company aiming for an IPO might find its audit revealing weaknesses in internal controls, requiring adjustments to financial planning to address these issues before the IPO can proceed.

How Sound Financial Planning Can Mitigate Risks Identified During a Financial Audit

A robust financial plan, incorporating risk assessment and mitigation strategies, can significantly reduce the impact of issues uncovered during an audit. For example, a financial plan that includes regular cash flow monitoring and forecasting can mitigate the risk of liquidity crises revealed by an audit. Similarly, a comprehensive insurance program, as part of the financial plan, can lessen the impact of unforeseen events like lawsuits or natural disasters, risks that might be highlighted in an audit.

Diversification of investments, as recommended by financial advice and incorporated into the financial plan, can reduce the overall portfolio risk identified during an audit.

A Scenario Demonstrating the Interplay of Financial Advice, Auditing, Planning, and Goals

Imagine a small business owner, Sarah, aiming to expand her bakery within five years. She seeks financial advice, resulting in a financial plan that includes securing a small business loan, implementing inventory management software, and developing a targeted marketing strategy. After two years, a financial audit reveals that while revenue is growing, profit margins are lower than projected due to inefficient inventory management.

Based on this audit, Sarah revises her financial plan, focusing on improving inventory control and reducing waste. She might also seek additional financial advice on optimizing pricing strategies. This continuous cycle of planning, auditing, and adjustment, guided by financial advice, increases the likelihood of Sarah achieving her long-term goal of expanding her bakery.

From ensuring regulatory compliance to optimizing operational efficiency, financial audits are essential for maintaining financial health and achieving long-term organizational goals. Understanding the nuances of different audit types—financial statement, compliance, operational, and internal controls audits—empowers businesses to proactively manage risk, improve internal processes, and make data-driven decisions. By effectively utilizing audit findings, organizations can enhance their financial planning, achieve strategic objectives, and build a strong foundation for sustained success.

The choice of audit type depends heavily on specific needs and objectives, highlighting the importance of careful consideration and professional guidance when selecting an audit approach.

Detailed FAQs

What is the difference between an auditor and an accountant?

Accountants primarily focus on recording and summarizing financial transactions, while auditors independently examine those records to verify their accuracy and compliance with regulations.

How often are financial audits required?

Frequency depends on factors like company size, industry, and regulatory requirements. Public companies typically undergo annual audits, while private companies may have less frequent audits.

What are the potential consequences of failing an audit?

Consequences can range from corrective actions and remediation to legal penalties, reputational damage, and difficulty securing financing.

Can I choose which type of audit my company undergoes?

The choice of audit type depends on your specific needs and objectives. Consult with financial professionals to determine the most appropriate type of audit for your circumstances.