Navigating the complexities of financial audits can be daunting for any company, regardless of size. A comprehensive checklist serves as an invaluable roadmap, ensuring thoroughness and compliance. This guide delves into the creation and application of a robust financial audit checklist, covering key areas from revenue recognition to risk assessment and regulatory compliance. We’ll explore the various types of audits, the importance of internal controls, and the crucial role of accurate financial statement analysis.

Understanding the intricacies of financial auditing is paramount for maintaining financial health and minimizing risks. This guide provides a practical framework, equipping businesses with the tools to conduct efficient and effective audits, ultimately contributing to greater transparency and accountability.

Introduction to Financial Audit Checklists for Companies

A comprehensive financial audit checklist is a crucial tool for ensuring the accuracy and reliability of a company’s financial statements. Its importance transcends company size, offering benefits from small startups navigating initial growth to large multinational corporations managing complex financial operations. A well-structured checklist streamlines the audit process, minimizes errors, improves efficiency, and ultimately enhances the credibility and trustworthiness of the financial reporting.The use of a checklist facilitates a consistent and thorough examination of financial records, reducing the risk of overlooking critical information or inconsistencies.

This is particularly vital for smaller companies with limited internal audit resources, providing a structured framework to guide them through the process. For larger companies, a checklist ensures uniformity across different departments and subsidiaries, maintaining a high standard of financial reporting across the entire organization. The resulting improved accuracy and reliability fosters investor confidence, strengthens relationships with lenders, and ultimately contributes to a more stable and sustainable business environment.

Types of Financial Audits and Their Respective Checklists

Financial audits are categorized into various types, each demanding a tailored approach and checklist. The scope and depth of the checklist directly reflect the nature of the audit. For instance, a financial statement audit, the most common type, requires a far more extensive checklist than a review engagement. A compilation engagement, involving minimal assurance, will have a comparatively simpler checklist.

Each type necessitates a different level of detail and procedural steps, resulting in unique checklist designs.

Key Areas Covered in a Typical Financial Audit Checklist

A typical financial audit checklist encompasses several key areas, ensuring a comprehensive assessment of the company’s financial health. These areas are interconnected and often overlap, but a well-structured checklist clearly delineates each for clarity and thoroughness.

- Revenue Recognition: This section verifies the accuracy and completeness of revenue reporting, ensuring compliance with relevant accounting standards. The checklist would include steps to review contracts, invoices, and sales records, confirming that revenue is recognized appropriately based on the performance obligation. For example, it would check if revenue is recognized upon delivery of goods or completion of services, as opposed to when payment is received.

- Expenses: This critical area focuses on the proper recording and classification of expenses. The checklist would involve reviewing expense reports, purchase orders, and payment records, ensuring that expenses are appropriately documented and allocated to the correct accounts. An example would be verifying that travel expenses are properly supported by receipts and align with company policy.

- Assets and Liabilities: This involves a thorough examination of the company’s balance sheet, verifying the existence, ownership, and valuation of assets and liabilities. The checklist would guide the auditor through procedures such as confirming bank balances, reviewing inventory counts, and examining loan agreements. This ensures that assets are accurately recorded and liabilities are appropriately recognized.

- Internal Controls: A robust internal control system is crucial for financial reporting reliability. The checklist would include steps to assess the design and operating effectiveness of internal controls over financial reporting. This might involve reviewing internal control documentation, observing control procedures, and performing tests of controls to identify any weaknesses or deficiencies.

- Compliance: Adherence to relevant laws and regulations is paramount. The checklist would incorporate steps to ensure compliance with tax laws, accounting standards (such as GAAP or IFRS), and industry-specific regulations. For example, the checklist might include steps to verify the proper calculation and payment of sales tax.

Compliance and Regulatory Requirements

A robust financial audit checklist must incorporate relevant accounting standards and regulatory requirements to ensure the accuracy and reliability of financial statements. Failure to adhere to these standards can lead to significant legal and financial repercussions for the company. This section details how to integrate compliance into your audit checklist design and highlights the potential consequences of non-compliance.

Relevant Accounting Standards and Regulations

The specific accounting standards and regulations applicable to a company’s financial audit depend heavily on factors such as its industry, location, and legal structure. Generally Accepted Accounting Principles (GAAP) are widely used in the United States, while International Financial Reporting Standards (IFRS) are prevalent internationally. Other regulations, such as those pertaining to securities laws, tax codes, and industry-specific rules, also significantly influence the audit process.

Understanding these diverse regulatory frameworks is critical for designing a comprehensive checklist.

Incorporating Compliance Requirements into Audit Checklist Design

Integrating compliance requirements into the audit checklist involves a systematic approach. First, identify all applicable standards and regulations. Then, translate these requirements into specific, testable checklist items. For example, if a regulation mandates the proper capitalization of intangible assets, the checklist should include items verifying the correct accounting treatment of such assets, including supporting documentation review. The checklist should be structured logically, following the natural flow of the financial statement preparation and review process.

Clear and concise wording is essential to avoid ambiguity and ensure consistency in application.

Implications of Non-Compliance and Potential Consequences

Non-compliance with accounting standards and regulations can result in severe consequences. These can range from financial penalties and legal action to reputational damage and loss of investor confidence. Material misstatements in financial statements can lead to lawsuits, regulatory investigations, and even criminal charges. Furthermore, non-compliance can hinder a company’s ability to secure financing, enter into business partnerships, and maintain a positive public image.

The severity of the consequences depends on the nature and extent of the non-compliance.

Documentation Needed to Demonstrate Compliance

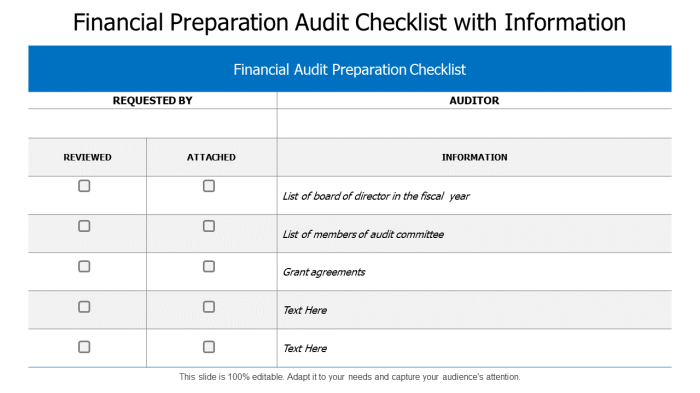

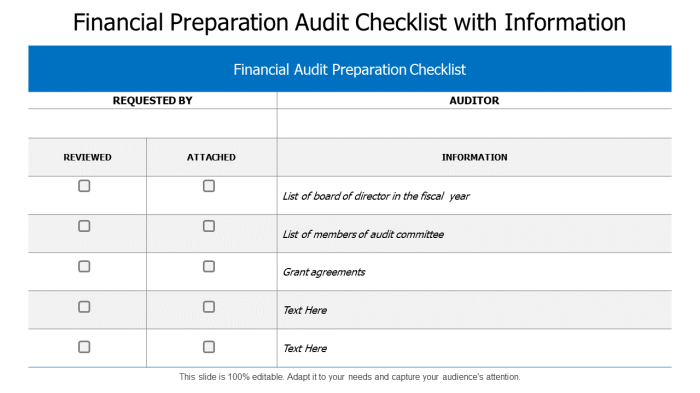

Maintaining comprehensive documentation is crucial for demonstrating compliance. This includes supporting documentation for all significant accounting transactions and judgments. Examples of such documentation include board minutes approving accounting policies, contracts related to significant transactions, internal control documentation, and reconciliations of key accounts. The documentation should be readily accessible and well-organized to facilitate efficient audit procedures. Adequate documentation provides an audit trail, allowing auditors to trace transactions from their initiation to their final recording in the financial statements.

Key Compliance Requirements and Corresponding Checklist Items

| Compliance Requirement | Checklist Item | Supporting Documentation | Potential Non-Compliance Issue |

|---|---|---|---|

| Proper revenue recognition (in accordance with relevant accounting standards) | Review sales contracts and supporting documentation for revenue recognition compliance | Sales contracts, invoices, shipping documents | Early revenue recognition, improper revenue allocation |

| Accurate valuation of inventory | Verify inventory count procedures and valuation methods | Inventory count sheets, cost records, valuation reports | Overstatement or understatement of inventory |

| Appropriate accounting for intangible assets | Review amortization schedules and impairment tests for intangible assets | Amortization schedules, impairment test calculations, asset register | Incorrect amortization or failure to recognize impairment |

| Compliance with internal controls over financial reporting | Assess the design and operating effectiveness of key internal controls | Internal control documentation, test results, management assessments | Material weaknesses in internal control |

Implementing a well-structured financial audit checklist is not merely a regulatory requirement; it’s a strategic investment in a company’s long-term stability and success. By meticulously addressing each area Artikeld in this guide, businesses can proactively identify and mitigate potential risks, ensuring the accuracy and reliability of their financial reporting. This proactive approach fosters trust with stakeholders and lays the groundwork for informed decision-making, driving sustainable growth and profitability.

Key Questions Answered

What is the difference between a GAAP and IFRS audit?

GAAP (Generally Accepted Accounting Principles) is used primarily in the US, while IFRS (International Financial Reporting Standards) is used internationally. The checklists will differ slightly to reflect the specific requirements of each standard.

How often should a company conduct a financial audit?

Frequency depends on factors like company size, industry, and regulatory requirements. Publicly traded companies typically undergo annual audits, while smaller private companies may conduct audits less frequently.

What happens if discrepancies are found during an audit?

Discrepancies are addressed through corrective actions, which may include adjustments to financial statements and improvements to internal controls. The severity of the discrepancy determines the necessary response.

Who should conduct a financial audit?

Ideally, an independent, qualified auditor with relevant experience and expertise should conduct the audit to ensure objectivity and impartiality.